Matcha powder is a fast-growing global commodity, but importing and exporting it requires careful attention to certifications, regulations, and logistics. Whether you are an importer, distributor, or retailer, understanding the compliance requirements is critical for smooth customs clearance and successful market entry. This guide covers the essential certifications, export documents, and shipping methods for bulk and private label matcha.

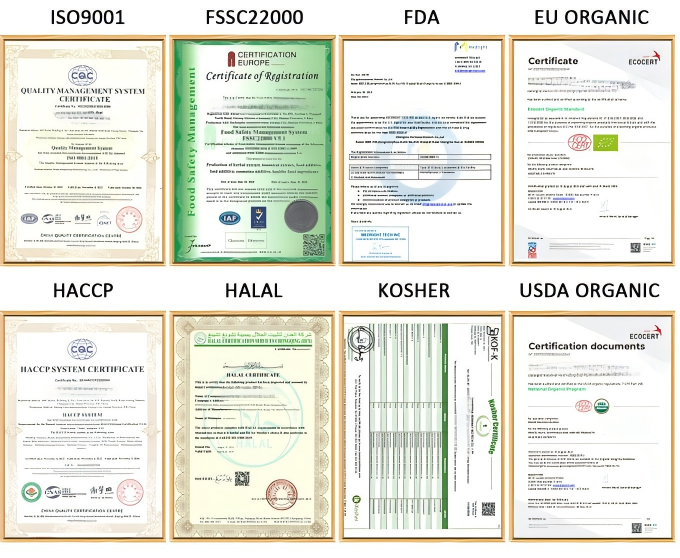

Why Certifications Matter in Matcha Trade

Certifications are often required for customs clearance, retailer approval, and consumer trust. Without them, your shipment risks delays, rejections, or limited sales opportunities.

Essential Matcha Certifications

| Certification | Region Required | Purpose |

|---|---|---|

| USDA Organic | USA | Required for organic retail channels |

| EU Organic | European Union | Essential for EU organic compliance |

| Halal | Middle East, Asia | Access to Muslim consumer markets |

| Kosher | USA, Israel | Access to Jewish consumer markets |

| HACCP / ISO22000 | Global | International food safety standards |

| FDA Registration | USA | Import compliance for food products |

👉 Tip: Always request a Certificate of Analysis (COA) for each batch to verify pesticide, heavy metal, and microbiological safety.

Export & Import Documentation

To ensure smooth trade, exporters and importers should prepare the following:

- Commercial Invoice (details product, price, buyer, seller)

- Packing List (quantity, packaging type, net/gross weight)

- Certificate of Origin (COO)

- Phytosanitary Certificate (required by some countries for tea imports)

- COA (Certificate of Analysis)

- Bill of Lading / Airway Bill

Shipping Methods for Matcha

| Shipping Method | Best For | Delivery Time | Cost Level |

|---|---|---|---|

| Courier (DHL/FedEx/UPS) | Samples / <20 kg | 7–10 days | High |

| Air Freight | 20–500 kg | 10–15 days | Medium |

| Sea Freight (LCL/FCL) | 500 kg+ | 25–40 days | Low |

Lead Time:

- Production: 3–7 working days

- Export paperwork: 2–5 working days

Importer Checklist: What to Confirm Before Buying

| Step | Why It Matters |

|---|---|

| Verify Certifications | Avoid customs rejection |

| Confirm COO & COA | Required by most import authorities |

| Choose Shipping Mode | Impacts cost and delivery speed |

| Estimate Duties/Taxes | Prevent hidden costs |

| Clarify Incoterms | EXW, FOB, CIF, or DDP responsibility |

👉 For the US and EU, duties for matcha powder are usually low, but VAT/GST applies on retail sales.

Common Challenges in Matcha Trade

- Customs Delays – missing COA or unclear labeling

- Certification Gaps – lack of Halal/Organic limits market access

- Incorrect HS Codes – may cause overpayment of tariffs

- Improper Packaging – risk of matcha oxidation during transit

[Image: Illustration of cargo container with caution signs]

Conclusion

Exporting and importing matcha requires proper certifications, complete documents, and efficient logistics planning. Importers and distributors should always confirm compliance with their local market before placing orders.

👉 Work with an experienced matcha exporter who can provide full certification, transparent documentation, and global shipping support.

[Image: Cargo containers being loded at port with matcha shipment highlight]

FAQ

Do I need FDA registration to import matcha into the US?

Yes, all food imports into the US must be FDA registered.

Which certifications are most important for Europe?

EU Organic certification and COA are required for customs clearance.

Can I import matcha without Halal or Kosher?

Yes, but you cannot sell to markets or retailers that require it.

What’s the HS code for matcha?

HS Code: 0902.10 (Green Tea, unfermented, in powder form).

How long does shipping take from China to the US or Europe?

Courier: 7–10 days; Air Freight: 10–15 days; Sea Freight: 25–40 days.